The Power of Compound Growth: How $10,000 Invested at Birth in 1965 Could Become Over $1 Million by 2025

Last Updated: January 25, 2026

Disclaimer: I am not a licensed financial advisor, financial planner, tax professional, attorney, or employment consultant. The information provided in this blog is intended solely for general informational and educational purposes. This content should not be interpreted or construed as professional advice on financial, legal, tax, employment, or career matters. Always consult with a qualified professional before making decisions that relates to your personal situation. For transparency, some articles may include AI-assisted content. The idea is my own. All material is reviewed, edited, and approved before publication to ensure clarity and accuracy.

Introduction: Unlocking the Secret of Lifetime Wealth

Wealth is often imagined as something built through extraordinary effort, luck, or massive starting capital. Yet history and mathematics reveal a quieter truth: wealth is most often built through time, patience, and the power of compounding.

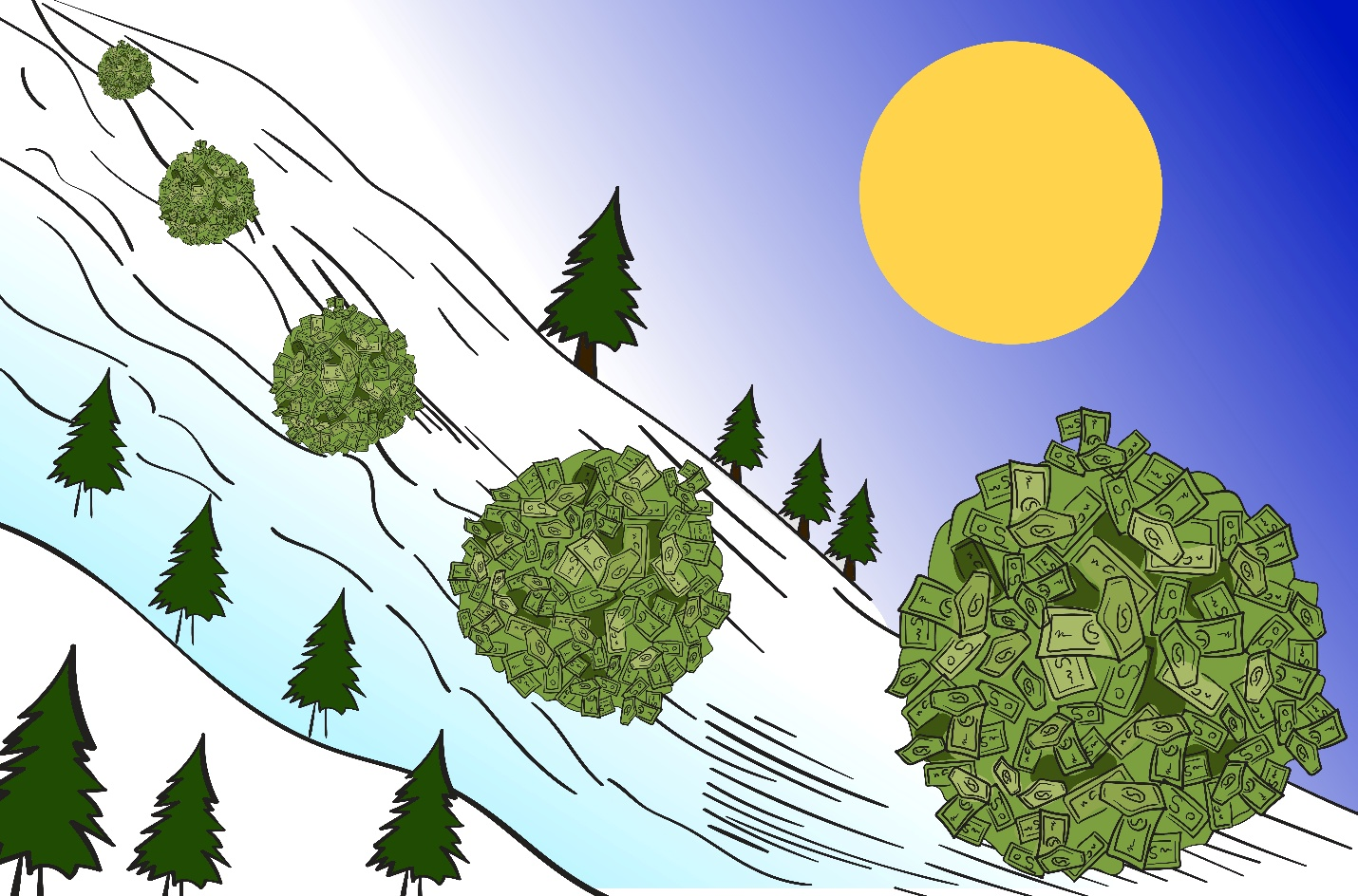

Consider this scenario: if a parent, guardian, or custodian had invested $10,000 in a newborn’s name in 1965, left untouched, that single act could have transformed into more than $1 million by 2025 at an average annual return of 8%. The same principle applies whether the starting amount is modest or substantial — compounding rewards time more than size.

In this blog, we will explore the mechanics of compound growth, the influence of inflation, the importance of diversification, and the psychological resilience required to stay invested for decades. Most importantly, it demonstrates through clear examples how early investments can create extraordinary outcomes, offering timeless lessons for anyone planning for the future of a child or family legacy.

Table of Contents

- Understanding Compound Growth and the Time Value of Money

- The Role of Long-Term Investment Strategies

- How Inflation Shapes the Value of Money Over Time

- Risk, Diversification, and Market Volatility

- The Mathematics Behind Compounding Returns

- Psychology of Long-Term Investing

- Practical Lessons from the $10,000 Hypothetical Scenario

- Step-by-Step Example: $10,000 Invested in 1965 at 8% Return

- Scaling the Scenario: $100,000, $500,000, and $1,000,000 Investments

- Practical Lessons for New Parents and Guardians

- Why Starting Early Matters More Than Starting Big

- What I Would Do with the Money

- A different perspective

- Wealth as a tool, not a toy

- Conclusion: The Timeless Lesson of Patience and Growth

- Why Most People Don’t Take Advantage of Compounding

- The answer is …

1. Understanding Compound Growth and the Time Value of Money

- Compound growth reinvests earnings over and over again, creating growth on both the original principal and accumulated returns.

- The longer the time horizon, the more powerful compounding becomes.

- Even small annual returns can snowball into significant wealth over decades.

- The time value of money means that funds invested today may have greater earning potential than the funds invested later.

- Compounding is exponential, and not linear. Its growth accelerates as time passes.

- Early investments may benefit disproportionately compared to later contributions.

Unlock your financial freedom.

Download this FREE eBook!.

How to make $100,000/month? Stop being average and think big.

Stop Settling. Start Scaling.

Unlock the mindset, systems, and strategies top earners use to build unstoppable income.

Think Bigger. Earn Smarter.

This free eBook serves as your blueprint for scaling quickly, earning relentlessly, not settling for mediocrity, and living life on your terms.

Inside, you’ll discover:

- The Millionaire Mindset Blueprint

- Income streams that run on autopilot

- Entrepreneur hacks for focus and financial dominance

- One strategy to launch multiple income streams

- How to break free from “just enough”

- Tools to crush limiting beliefs and build your empire

Average doesn’t scale. Vision does. Download now and start your $100K/month transformation.

Yes, this eBook is free. Just drop in your email here to get instant access. ONE eBook per email.

The eBook is sent automatically and should arrive within minutes. Depending on your email provider, it may appear in your Spam or Promotions folder. While we don’t control its exact placement, you can be confident it has been dispatched and is waiting for you.

PLUS: Get Access to exclusive financial tips, learn everything about money and get early blog updates – delivered directly to your inbox .

2. The Role of Long-Term Investment Strategies

- Long-term strategies focus on consistency rather than short-term gains.

- Reinvesting dividends or interest can maximize its compounding effects.

- Avoiding frequent withdrawals preserves growth momentum.

- Patience allows investments to recover from temporary downturns.

- Asset allocation tailored to long horizons may reduce risk exposure.

- Minimizing transaction costs and fees can help protect long-term returns.

- Staying invested through market cycles can ensure participation in overall upward trends.

3. How Inflation Shapes the Value of Money Over Time

- Inflation reduces the purchasing power, meaning future dollars may buy less than today’s.

- Investments must outpace inflation to preserve real wealth.

- Inflation-adjusted returns can provide a clearer picture of actual growth.

- Compounding must be considered alongside inflation to assess true outcomes.

- Long-term investors must account for inflation when setting goals.

- Inflation highlights the importance of growth-oriented assets over stagnant savings.

- Even modest inflation rates can significantly impact wealth over decades.

4. Risk, Diversification, and Market Volatility

- Risk is inherent in all investments; diversification helps spread and mitigate its exposure.

- Diversification can help reduce the impact of poor performance in any single asset class.

- Market volatility is temporary, but diversification may help cushion its effects.

- A balanced portfolio can maximize its growth potential while minimizing catastrophic losses.

- Risk tolerance must align with your investment horizon.

- Diversification across asset classes, sectors, and geographies may enhance stability.

- Long-term investors can benefit from resilience against short-term fluctuations.

5. The Mathematics Behind Compounding Returns

- Formula: A = P.(1+r)t

- Small differences in return rates can create massive differences over decades.

- Example: 5% annual return vs. 8% annual return may lead to vastly different outcomes after 60 years.

- Exponential growth means later years may tend to contribute disproportionately to wealth accumulation.

- Understanding the math may help us reinforce the importance of patience.

- Compounding shows why early investments can outperform larger contributions made later.

- Growth accelerates as time passes, making long time horizons invaluable.

6. Psychology of Long-Term Investing

- Emotional discipline prevents impulsive reactions to market swings.

- Patience is essential for compounding to work effectively.

- Long-term focus can help reduce stress from short-term volatility.

- Resisting fear during downturns can help preserve growth potential.

- Confidence in long-term strategies can build resilience.

- Avoiding herd mentality can protect investors from making poor decisions.

- Psychological strength is as important as having financial knowledge.

7. Practical Lessons from the $10,000 Hypothetical Scenario

- A $10,000 investment at birth illustrates the transformative power of time.

- Even modest returns can compound into significant wealth over decades.

- The scenario highlights that wealth accumulation is not solely dependent on large sums of capital. Even small amounts matter.

- Patience and discipline are more important than making frequent contributions.

- The hypothetical example demonstrates the importance of starting early.

- It shows how inflation-adjusted growth must be considered.

- The lesson is clear: compounding rewards time more than the size of the investment.

8. Step-by-Step Example: $10,000 Invested in 1965 at 8% Return

- Step 1: Identify the time horizon→ 60 years (1965–2025).

- Step 2: Apply the formula A = 10,000 . (1.08)60

- Step 3: Calculate the growth A ~ 10,000 . 101.257 = 1,012,570

- Step 4: Result→ By 2025, $10,000 grows to about $1,012,570.

- Step 5: Key takeaway→ Even a modest sum, left untouched, can grow into over a million dollars through the power of compounding.

9. Scaling the Scenario: $100,000, $500,000, and $1,000,000 Investments

- $100,000 invested in 1965→ about $10.1 million in 2025.

- $500,000 invested in 1965→ about $50.6 million in 2025.

- $1,000,000 invested in 1965→ about $101.3 million in 2025.

10. Practical Lessons for New Parents and Guardians

- A single early investment can create long-term security.

- Compounding usually rewards patience more than making frequent adjustments.

- Inflation must be considered when planning for future needs.

- Diversification helps ensure resilience against market volatility.

- Emotional discipline is critical for staying invested.

- The earlier the start, the greater the reward.

11. Why Starting Early Matters More Than Starting Big

- Time magnifies even small investments.

- A modest sum invested early can outperform larger sums invested later.

- Early investing helps build habits of discipline and foresight.

- Starting early may reduce the reliance on high-risk strategies.

- Compounding rewards patience, not urgency.

- Early investments can benefit from decades of exponential growth.

- The principle emphasizes that consistency beats timing.

What I Would Do with the Money

- Respect the Journey of Compounding

- That money represents 60 years of patience and discipline.

- Cashing it out recklessly would erase the very lesson that created it: the power of time and compounding.

- I’d treat it as a legacy, and not just a windfall. I would respect every one of those dollars and the person who would have sacrificed everything for me.

- That initial capital was invested through sacrifice, blood, sweat, tears, and years of toiling. Imagine what that person might have gone through to make that $1.00. $1.00 may not seem much now, but back then, it might have been like $100.00 in today’s dollars equivalent.

- Evaluate Needs vs. Wants

- I’d separate essential needs (security, healthcare, housing, and education) from luxury wants (travel, impulse buys, shopping in general, and indulgences).

- A portion of it could be used to improve the quality of life, but the majority would remain invested to continue growing.

- Preserve and Diversify

- Rather than cashing out entirely, I’d diversify into safer, income-generating assets that can give me a predictable, reliable, and definitive cash flow month over month without fail. That’s what I call fail-proof revenue.

- This ensures the money continues to work for me, providing stability and passive income in perpetuity.

- Create Generational Impact

- The money could be structured to benefit not just me, but for future generations.

- Setting aside funds for education, opportunities, or even charitable causes would amplify its impact. That would be the footprint I would leave behind.

- Balance Enjoyment with Responsibility

- I wouldn’t deny myself enjoyment. Some of the money could be used for meaningful life experiences and not on stuff.

- I would avoid ‘blowing it’ on a supercar or a vacation home, because wealth is most powerful when it creates freedom, security, and opportunity, rather than fleeting thrills.

A Different Perspective

The real question isn’t whether to leave it untouched or spend it all. It’s how to honor the patience that created it. Money accumulated through compounding is a testament to discipline. To squander it would be to ignore the lesson; to preserve and grow it further would be to respect the principle. But if we do the opposite, we would show no respect to the person who helped create it for us, and that would not be the right thing to do.

If I were holding that wealth today, my actions would be:

- Keep the majority invested to continue compounding.

- Use a portion responsibly for investing in life-enhancing experiences.

- I would not indulge myself in buying stuff or anything that depreciates.

- Build a legacy that outlives me, ensuring the money continues to serve a purpose beyond my lifetime.

Wealth as a Tool, not a Toy

Wealth created through compounding is not just a number: it’s a story of patience, discipline, and foresight. To cash out and blow it would be to treat it as a toy. To preserve, diversify, and use it wisely would be to treat it as a tool for freedom, security, and legacy creation.

If I had that money today, I would choose the latter path: enjoy some, preserve most, and ensure it continues to grow and serve a purpose for decades to come.

Conclusion: The Timeless Lesson of Patience and Growth

The hypothetical journey of $10,000 invested at birth in 1965 is more than a mathematical exercise: it is a profound reminder of the extraordinary potential hidden within time and discipline. Compound growth is not a secret reserved for financial experts or for the wealthy. It is a universal principle accessible to anyone willing to start early and remain patient.

When scaled to larger sums, the lesson becomes even more striking: $100,000 could grow into $10 million, $500,000 into $50 million, and $1 million into more than $100 million. These outcomes are not the result of speculation or luck, but of time, compounding, and consistency.

The timeless truth is clear: wealth is not built overnight but cultivated steadily, quietly, and persistently. By embracing the power of compounding, respecting the influence of inflation, diversifying wisely, and maintaining psychological resilience, anyone can unlock the door to long-term prosperity. All you may have to do is throw in the towel, sit on it, and watch it grow for decades without ever thinking of touching it. Just see it once and forget it.

Ultimately, the story of $10,000, or $1,000,000 invested at birth, is not about the money itself. It is about the enduring truth that patience, discipline, and time are the greatest allies in the pursuit of financial growth. If so, why is no one doing this, you might ask.

That’s a powerful question: if compounding is so effective, why isn’t everyone doing it? The answer lies in a mix of psychology, financial habits, and practical barriers. Let’s break it down:

Why Most People Don’t Take Advantage of Compounding

- Delayed Gratification Is Hard

- Compounding requires patience and decades of it.

- Many people prefer immediate rewards over long-term growth.

- The idea of waiting 40–60 years for results may feel abstract and distant, so most prioritize short-term spending.

- Lack of Financial Education

- Not everyone understands how compound growth works.

- Without exposure to the concept of reinvesting and letting money grow, people underestimate its power.

- Financial literacy gaps mean many don’t realize that even modest sums can become substantial amounts over time.

- Life Expenses and Pressures

- Daily realities like housing, healthcare, and education costs often take priority.

- People may not have the luxury of setting aside money for decades.

- They may not have access to that initial capital, which is usually a large sum of money.

- Emergencies or unexpected expenses can force withdrawals, breaking the effects of the compounding cycle.

- Impatience With Market Volatility

- Markets fluctuate, and downturns can scare investors.

- Many may even cash out too early, missing the long-term rebound.

- Emotional reactions may often override rational long-term strategies.

- Cultural Focus on Consumption

- Modern culture often celebrates spending and lifestyle upgrades.

- Buying cars, homes, or luxury items may feel more tangible than watching numbers grow in an account.

- This mindset may lead to “blowing it” rather than preserving it.

- Misconception That You Need Huge Capital

- People may assume that investing requires large sums to be worthwhile.

- In reality, even small amounts invested early can grow significantly over time.

- This misconception may prevent many from starting at all.

The Answer is …

So, why isn’t everyone doing this? Because compounding demands patience, discipline, and foresight: qualities that are often overshadowed by immediate needs, cultural pressures, and lack of financial education. The principle is simple, but the practice is difficult.

Those who embrace it understand that wealth is not built overnight. It is cultivated steadily, quietly, and persistently. That’s why compounding remains one of the most powerful yet underutilized tools in personal finance.

If I had that money today, I would treat it as more than just a financial windfall. It would be a symbol of patience, discipline, and the extraordinary power of compounding. This money is not just about what it can buy today. It is about what it represents: decades of growth, discipline, and foresight.

Final Statement: True wealth is not measured by how quickly it can be spent, but by how wisely it is preserved, enjoyed, and passed on to create freedom, security, and opportunity for generations to come.

Join the conversation! Drop your thoughts in the comments below, and let’s keep the discussion going.

makemoneyunstoppable.com

From Experience to insight : Transformational reads for the Strategic mind

Foundational readings for big shifts:

- How to Track Spending without Getting Overwhelmed

- The 7-Day Money Reset Plan: Take Back Control In Just One Week

- Are You Throwing Away $5,000 a Year on Food Waste Without Realizing It?

- The Real Cost of Owning a Big Home

- The Psychology of Spending: Why We Overspend and How to Stop It

- Mastering the Envelope Method

Author: Vaidya Selvan

Welcome to Make Money Unstoppable Personal Finance Made Simple, a blog born out of necessity, a space created from real-life experiences, hard-earned lessons, and a deep-seated desire to share what I wish someone had taught me or had known sooner.

Newsletter Invite

Want more real-world information on Money? Join my newsletter for practical tips, updates on my books, and strategies to help you build financial freedom on your terms.

Yes, the eBook is also free. Just drop in your email here to get instant access. ONE eBook per email.

The eBook is sent automatically and should arrive within minutes. Depending on your email provider, it may appear in your Spam or Promotions folder. While we don’t control its exact placement, you can be confident it has been dispatched and is waiting for you.

#FinancialFreedom #Newsletter #MoneyTips